Marble

The first digital rewards platform for insurance

Team involved

María Simó

Team Lead & Front-end Developer

Ana Menacho

Team Lead & Front-end Developer

Javier Pereira

Product Designer

RECOGNITIONS

The problem and user persona

Americans spend up to 10% of their household budget on insurance. A trillion-dollar asset that is still managed in an old fashion and chaotic way: managing dozens of documents, passwords, PDFs, and services.

Role

Maths & Natural Science Teacher

status

Married. One 10-year-old son

about

John has had the same car for over five years, which he uses every day to commute. He has a 10-year-old child with braces, two lovely shepherd dogs, and his own house outside New York in Westchester County.

Frustrations

John has 200 policy papers stored in a cabinet in his house garage and a 2-terabyte external hard drive filled with insurance documents mixed with pictures of his last holiday in the Hamptons. To keep safe what he cares most about, he pays a huge amount of money to insurance companies year after year, without receiving any reward for their loyalty.

He finds it super hard to fully understand the intricate market of insurance, and he doesn’t find the time to stay up to date with their policies, nor research new offers. This means sticks to the decisions he made five years ago when he bought his car or six years ago when his family adopted their pets.

The numbers

The American insurance market is a huge industry and one of the largest in the world as it continues to grow. Note down one fact: More than 4.6 million Americans have newly gained healthcare coverage since the Biden Administration took office in January 2021, according to the statistics of the CMS - Centers for Medicare and Medicaid Services.

The founder journey

Before launching Marble, Stuart Winchester was the General Manager of Better.com’s insurance vertical. After that, he spent one intense year researching the ins and outs of his insurtech idea of creating the first rewards program and virtual hub for all North Americans’ insurance needs.

It was almost unbelievable to him how Americans keep spending up to 10% of their household budget on insurance and how the industry has yet to introduce technology solutions for their clients or a modern loyalty approach.

Being a solo founder, in the early days of Marble’s conception, Stuart needed help to create his innovative idea. Adi Sundar, a product leader with 8+ years of experience across fintech, proptech, and enterprise product development, became Marble's CTO. We worked with Adi before building other startups like Loftsmart from inception to launch. He was sure our team would help them turn their idea into reality.

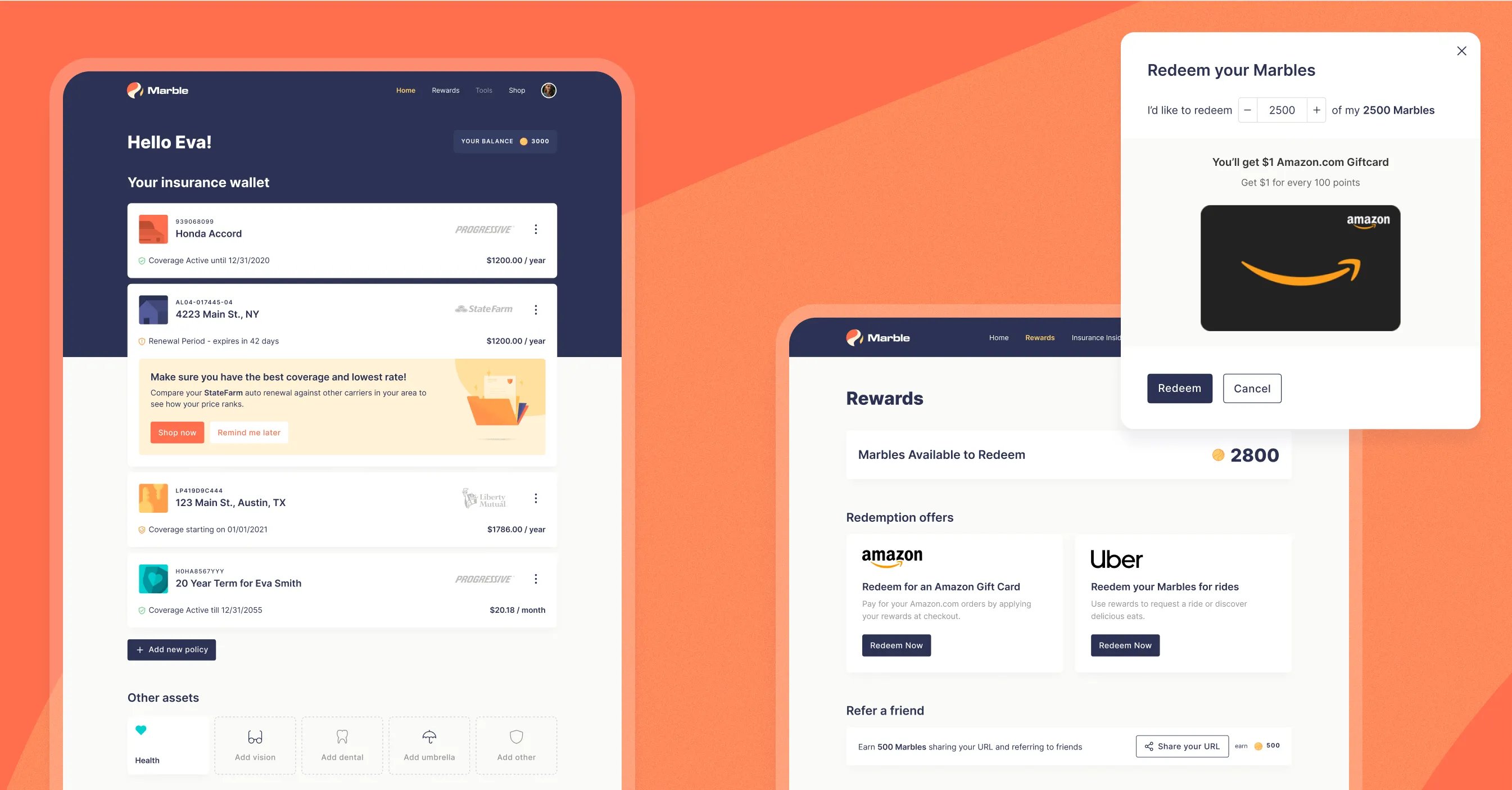

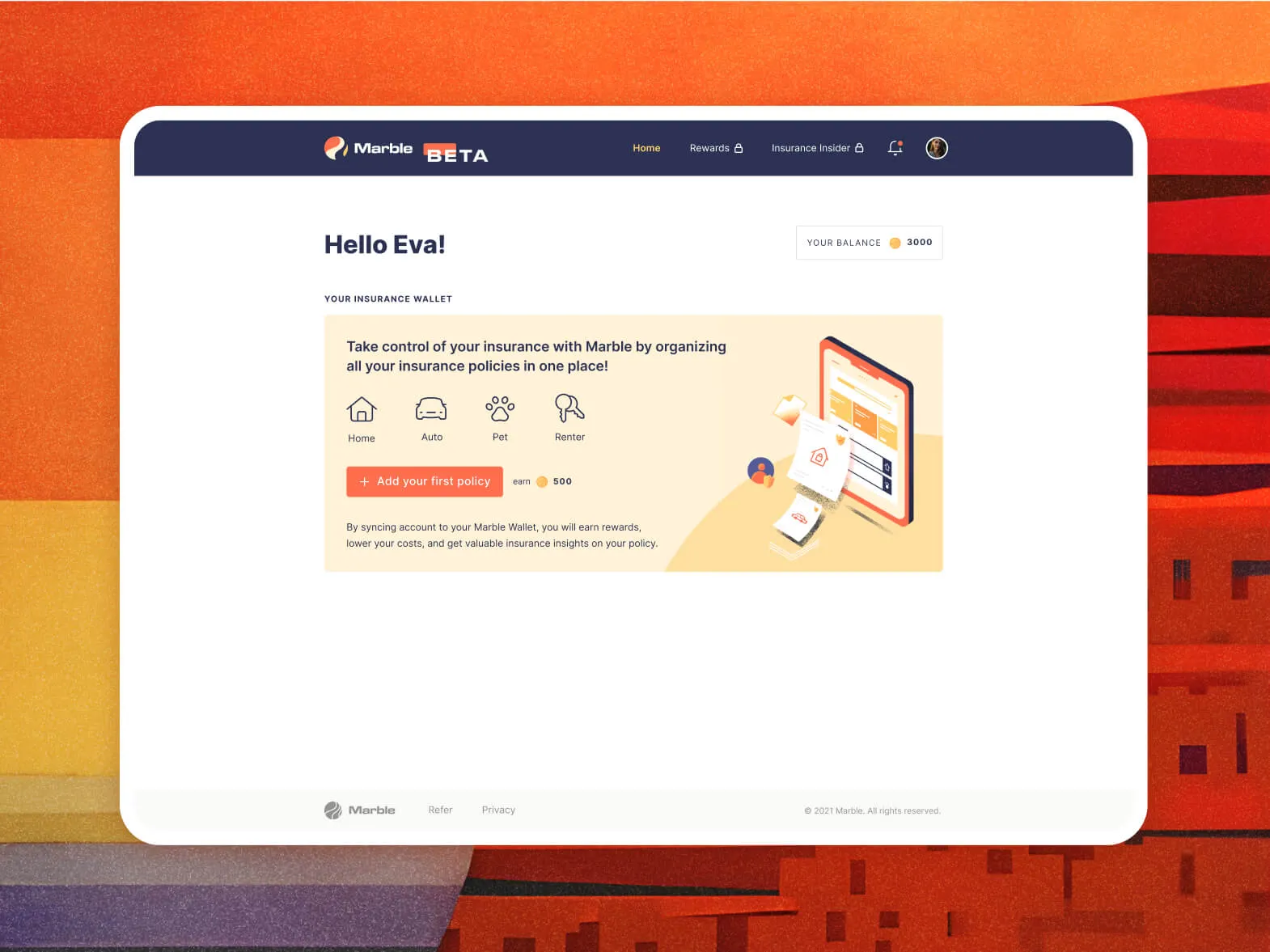

An intuitive and seamless UX

Marble needed to shed the complexity of the world of insurance, and we were pleasantly surprised at how smooth the process was when designing the UI. It wasn’t as tough as you might think when the word insurance comes to mind, and we were able to use our experience to create something generic yet essential within three months.

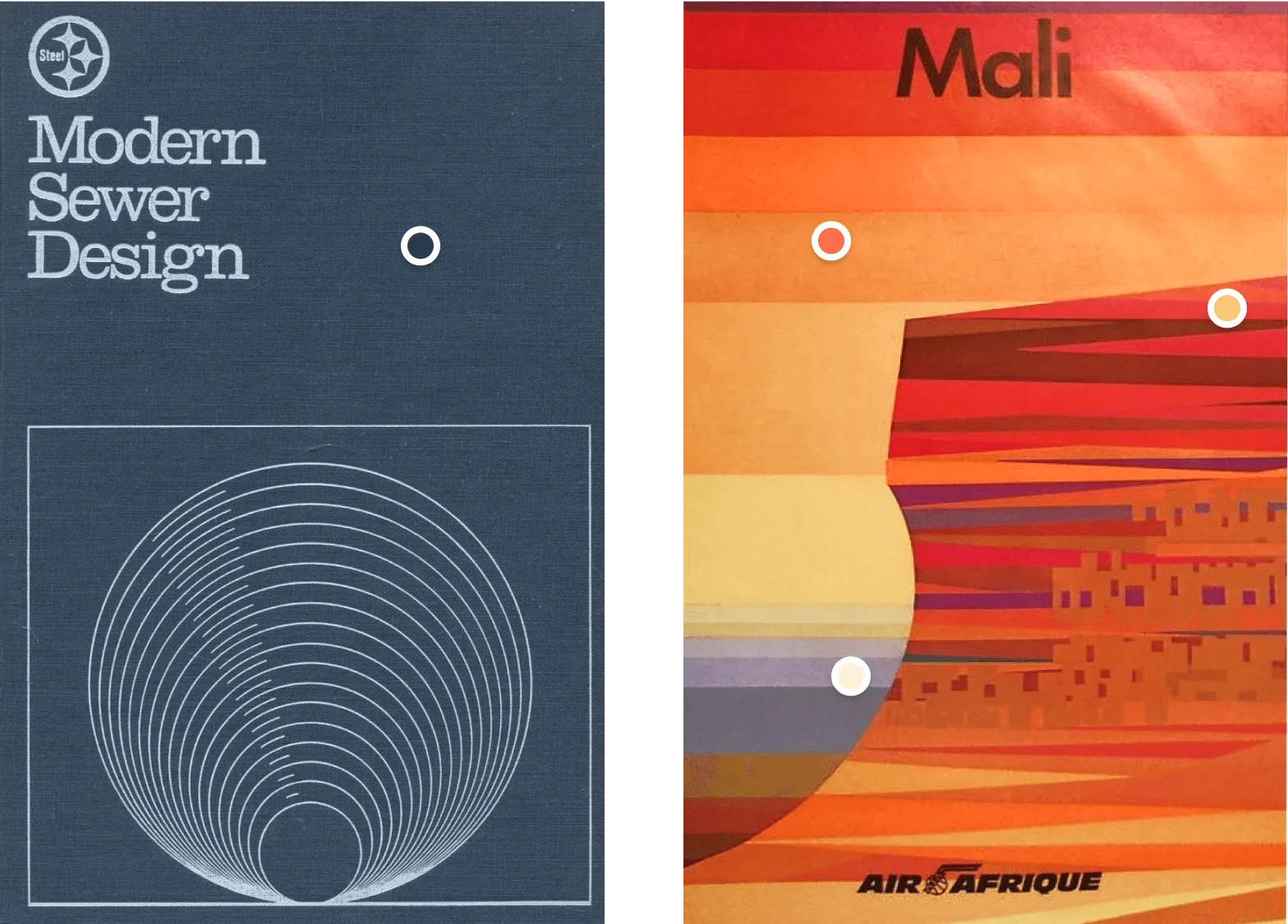

The visual design of the product , as well as the branding, was inspired by art from the 1970s, with our design team working together with Marble to produce a highly aesthetically pleasing experience.

Branding

Stuart wanted to use marbles because they’re fun, something you can collect, but also, in another context, a symbol of established banks and financial institutions. He also provided two references for the look and feel he wanted for Marble: Modern Sewer Design’s first edition book cover by American Iron and Steel Institute, and a vintage Air Afrique poster from Mali. We immersed ourselves in that unique universe for a while and got back with fresh ideas.

We used a higher proportion of warm colors and a few touches of cold to get vibrant, warm pieces that convey confidence to the consumer. Our design team created a beautiful set of illustrations that resemble toys to connect with Marble’s users. The pieces have their own personality throughout the app and website; no matter how simple they are, like a folder or a cabinet, they transmit transparency, trust, and security, great intangibles for a product like this.

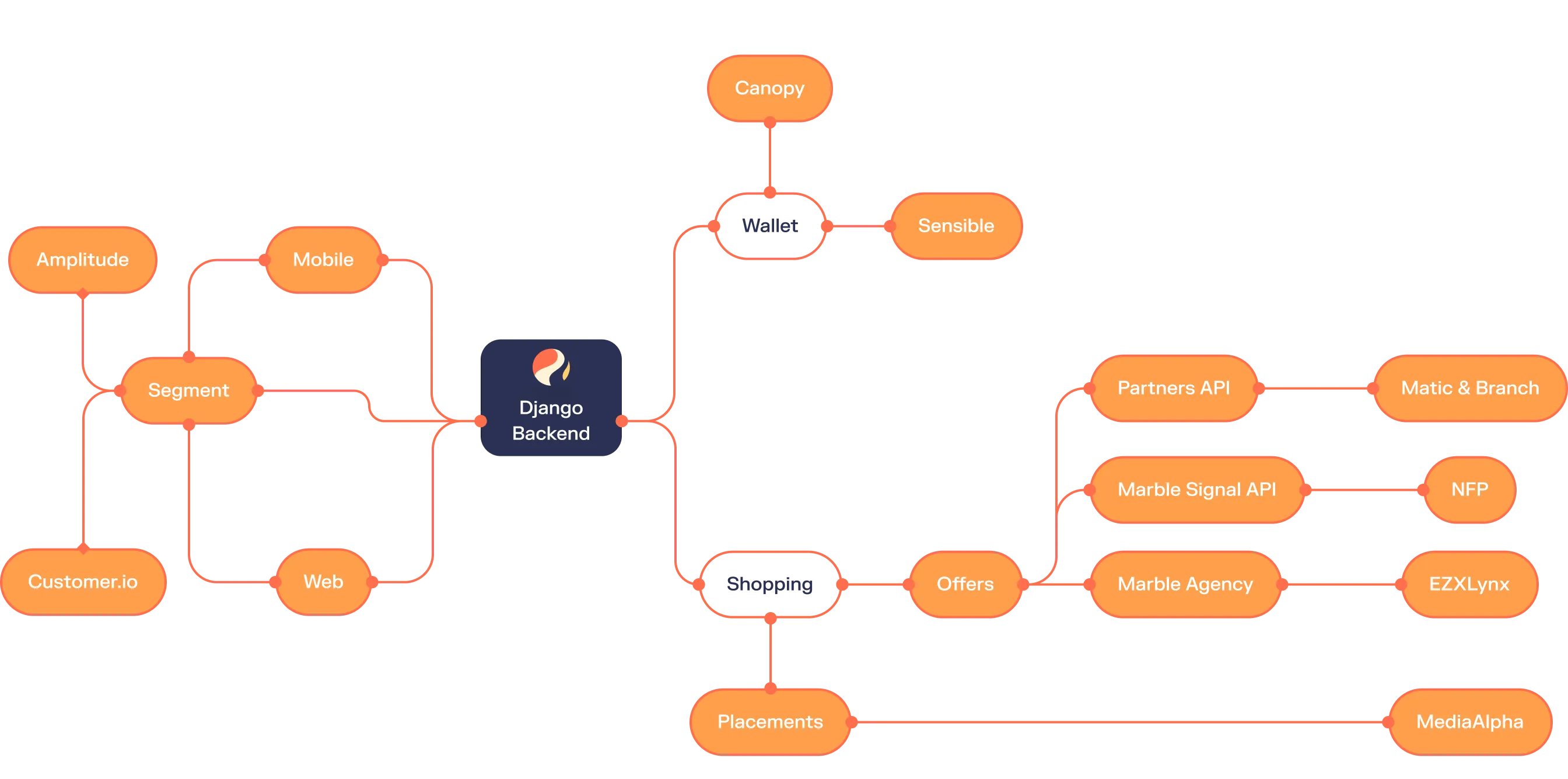

A robust backend and frontend

One of Marble’s key features is the digital wallet, where customers can store their insurance policies in a more user-friendly form than PDFs. In order to collect this sensitive data, we worked with Canopy, an API that leverages web scraping to securely obtain users’ policy data by means of their insurance credentials.

If preferred, users can upload their insurance policies directly to Marble, where the relevant data is extracted by Sensible, an API powered by machine learning. We also used React with TypeScript and Apollo GraphQL in the frontend as well as Django and Graphene in the backend.

The mobile app came around 18 months into Marble’s existence. We used React Native as a natural choice because, by this point, we had already built out a robust backend and web app frontend. We built the first part of the web app with a Django (Python) backend and a ReactJS frontend.

An app like no other

With a 5-star rating on the AppStore, it looks like everybody loves the app, including their lead investor Andrew Lerner, who is the Managing Partner of IA Capital Group. “The general UI/UX is simple and modern yet powerfully valuable to the user. It’s a lot of complex information organized elegantly, one of the best user experiences of any insurance app I’ve ever seen,” has claimed.

In fact, since launching the beta app in March of 2021, with hundreds of members signing up on the waiting list before the final product was released, all the feedback has been exceptionally positive

Now Marble has grown to have over 100,000 members (and counting!), having over $100 million in lifetime synced premium on the platform. It’s a unique app —its aesthetics make it rise above any other in the insurance industry, while its function as a one-stop hub for centralizing policies and earning rewards makes it indispensable for all policyholders.

We are proud to have been given the opportunity to help Stuart on his mission to improve the ecosystem for insurance companies and the 92% of Americans who are policyholders.

User feedback

Reflecting on the partnership and the final result as a whole, Stuart admits Z1 totally exceeded his expectations . “We interviewed a couple of different studios before partnering with Z1 and I couldn't be happier with our choice. The quality of their engineering work, exceptional product-minded execution, and talented designers have really all been totally critical to Marble's success.”

Was in the process of shopping for new insurance and used the marble tool to compare which was incredibly helpful in selecting a policy that saved me money and got the coverage I needed, I also LOVE that I can clearly view all my policies in one place and manage them easily rather than having to log into individual apps when life changes happen, Marble makes it easy to keep things up to date.

Product Hunt

Marble is great!

One of the better reward apps. Less hoops to jump through than competitors. The rate of earning is good. And it's all things you are gonna pay for anyways. Also good for a snapshot of all your different insurance policies in one place. Getting quotes is also painless. It is fast and easy. The app already has your info. You don't have to fill forms over and over. And they do not bombard your phone and email with solicitations. A+ get this app if only for the easy free money!

Google Play

As far as I am aware it’s the only app that allows you to earn rewards in the form of marbles for having insurance and knowing more about insurance. Works great and had no issues setting everything up. Very informative as well about insurance and helps you find and compare other insurance companies to maybe save some money. How to earn more marbles aside from adding insurance policies and completing their every now and then tasks and reads is a little confusing as I am not sure how else I can earn more other then that if there is other ways but all in all a very good app.

Apple AppStore

App is super useful and looks great! Enjoy linking my different insurance policies and earning marbles!

Product Hunt